Global markets are reeling after US President Donald Trump announced sweeping new tariffs this week—setting off what many now consider a full-scale trade war. For the UK, the implications could be far-reaching. A 10% tariff on British goods entering the US may seem like a geopolitical footnote, but for consumers, businesses, and investors, the ripple effects could land close to home.

So, what does this mean for your money?

1. Prices Could Rise – or Drop

Tariffs are essentially a tax on imported goods. In this case, US companies importing British goods will bear the cost—at first. But higher costs can feed back into global supply chains. UK firms may face increased costs for raw materials, particularly if the pound weakens against the dollar, as seen following Trump’s announcement. That can lead to price hikes for consumers in the UK.

Conversely, some economists suggest we might see an influx of discounted goods as exporters redirect shipments away from the US. Swati Dhingra, a member of the Bank of England’s Monetary Policy Committee, has suggested that a surge in redirected supply could lead to temporary price drops in the UK market.

2. Jobs Are at Risk

UK sectors heavily reliant on US exports—such as car manufacturing, pharmaceuticals, and electronics—are bracing for impact. With £60bn in UK exports heading stateside last year, a 10% levy could threaten thousands of jobs.

The Institute for Public Policy Research warns that up to 25,000 roles in the car industry could be at risk, particularly at Jaguar Land Rover and MINI’s Oxford plant. Meanwhile, life sciences giants like GSK and AstraZeneca could face complex cross-border tax charges as ingredients and products move between the UK, EU, and US under new tariff conditions.

3. GDP Growth Could Stagnate

The National Institute of Economic and Social Research (NIESR) predicts that the UK’s GDP growth rate could fall to zero by 2026, as the tariffs disrupt supply chains, raise prices, and dampen demand. The UK’s economy could struggle as higher tariffs reduce competitiveness, particularly in sectors like automotive and pharmaceuticals.

4. Interest Rates May Stay Higher for Longer

With UK interest rates currently at 4.5%, many were expecting cuts by year-end. But rising inflation due to tariffs could force the Bank of England to hold rates steady. Higher borrowing costs affect everything from mortgages and credit cards to small business loans.

The Bank has already cited global trade uncertainty as a reason for holding rates in March. If tariffs drive inflation, rate relief may be delayed.

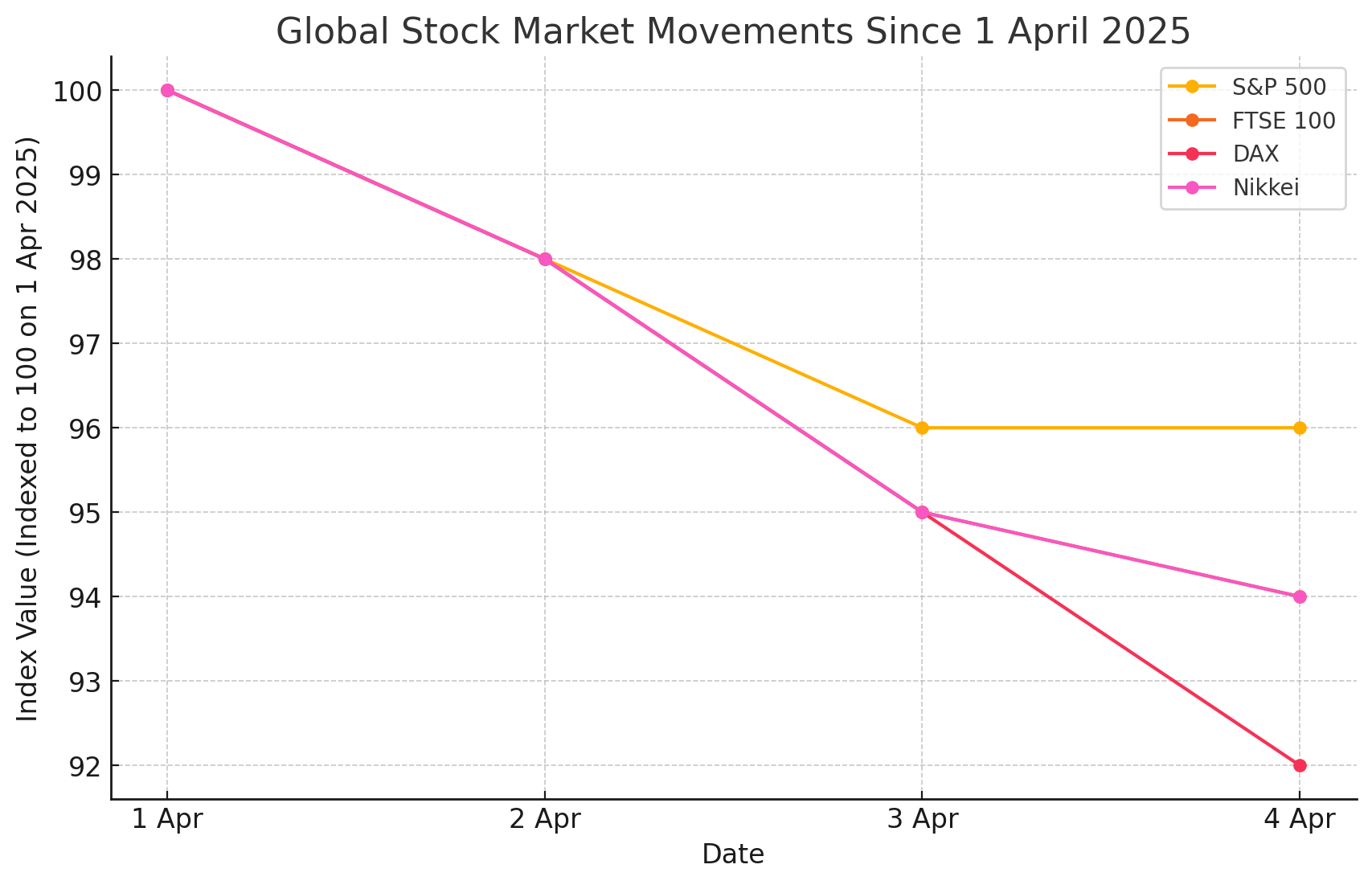

5. Markets Are Volatile – And Pensions Could Feel It

Markets across Europe and Asia have slumped in response to the tariffs. The FTSE 100 dropped over 3%, and key indices in Germany, France, and Japan followed suit. While it’s not yet a “crash” by definition, the tremors are worrying.

The Financial Times also notes that stock market volatility is expected to continue, particularly in sectors like automotive and luxury goods, where higher import costs will squeeze profits. This could impact pension funds, many of which are invested in equities.

6. Government Response and Retaliatory Measures

The UK government has opted not to immediately retaliate against the US metal tariffs. Officials emphasize the need for “cool heads” to prevent escalating trade tensions. Discussions are ongoing about potential adjustments to the UK’s Digital Services Tax to avoid further disputes with the US.

However, the UK is considering retaliatory tariffs on approximately 8,000 US products, including motorcycles and whiskey. The outcome of these talks could shape future trade relations and the broader economic landscape.

7. Sector-Specific Challenges: The Automotive Industry

The UK’s automotive sector is set to be one of the hardest hit by the tariffs. Manufacturers like Jaguar Land Rover face potential price hikes that could make UK-made cars less competitive in the US market, potentially leading to significant job losses. The University of Birmingham estimates a £6.2bn GDP loss in the West Midlands region by 2030 due to reduced automotive exports.

Stock Market Volatility: Are We Heading For A Crash?

With stock markets tumbling following the announcement of sweeping tariffs, many are wondering if this qualifies as a stock market ‘crash’.

That word, ‘crash’, has been used sparingly over the years, and is typically reserved for a very specific circumstance: a fall of over 20% from a recent peak in a single day, or over a short period. For example:

- October 19th, 1987 – Black Monday, which saw the US stock market lose 23% of it’s value in a single day, a decline that was then mirrored across global markets.

- 1929 – the infamous Wall Street Crash, which saw the US stock market losing over 20% in two days, and 50% in three weeks. This triggered the Great Depression.

Looking at the current situation, the US stock market lost 5% of its value on April 3rd 2025. Worrying, but the market is still 5% higher than it was a year ago. This indicates that while the markets are certainly turbulent, we’re not in ‘crash’ territory yet. That said, key markets look weak, particularly over sectors like banking and oil. While the current situation may feel like a crash, until we hit that 20% we’re looking at a situation that requires caution, rather than panic.

What Should You Do Now?

This is a fast-evolving situation, and at Blacktower, we understand the importance of staying ahead. Our advisers are closely monitoring the developments and their potential impact on investors, expatriates, and retirees. If you’re concerned about how these tariffs could affect your investments, pensions, or retirement plans, now is the perfect time to review your financial strategy.

Get in touch today for a personalised assessment of your financial situation with one of our dedicated professionals. We offer tailored cross-border financial planning solutions to help you navigate these uncertain times with confidence.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.